🔥 Top Stories

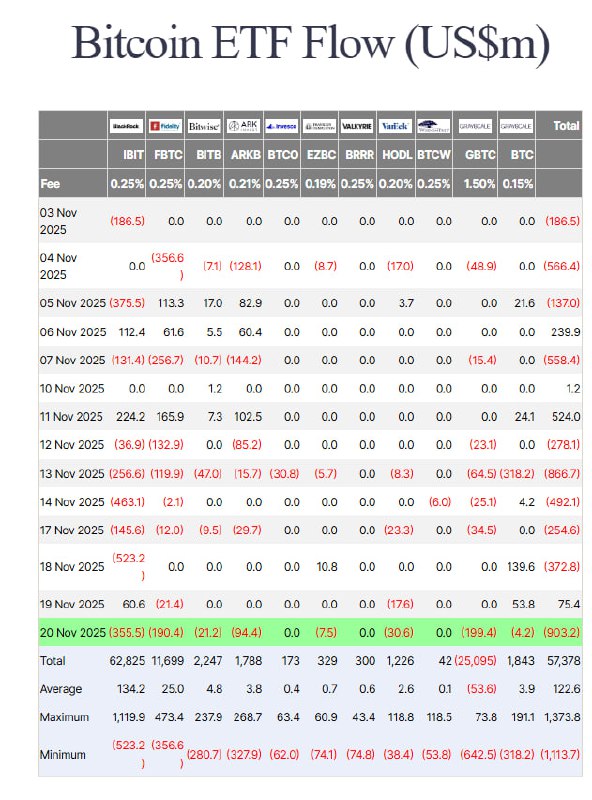

1. BlackRock’s IBIT drives a record $3.79B November exodus from U.S. spot Bitcoin ETFs, shedding $2.47B—63% of all outflows—as weekly redemptions hit an all-time high.

Source: farside.co.uk

2. Ryan Wedding, Ex-Olympian turned ‘El Chapo’ tapped these five blockchains to launder millions, authorities say

Source: DL News

"-Ryan Wedding’s organisation allegedly imported 60 metric tonnes of cocaine into Los Angeles in 2024.

-He and co-conspirators are accused of laundering funds using crypto, luxury goods, and front companies.

-The FBI has issued a $15 million reward for information leading to his arrest."

@Spencer420

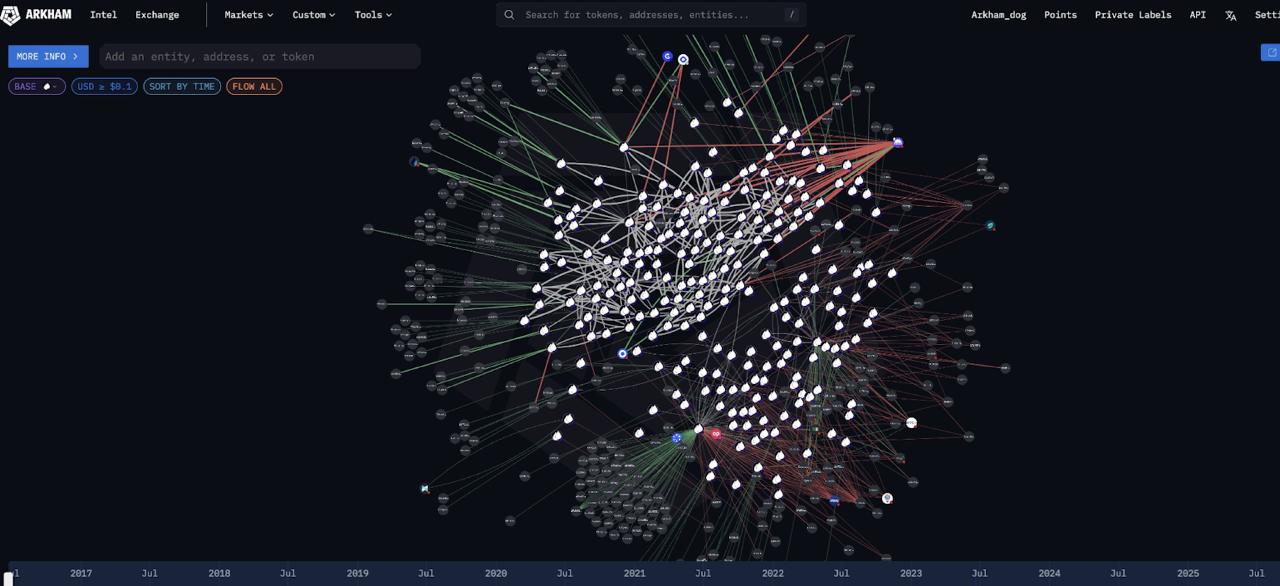

3. OG whale Owen Gunden has now fully exited his $1.3B Bitcoin stack, finishing with a final $230M transfer to Kraken after selling 11,000 BTC since October.

Source: 𝕏/@arkham

That's a lot of BTC...

@Spencer420

4. ETH-backed loans on Coinbase, powered by Morpho on-chain are now live

Source: 𝕏/@Morpho

Good update from the team. Definitely worth it

@Danicjade

5. Tether invests in Parfin to accelerate institutional use cases of digital assets in LATAM and improve access to efficient, blockchain-based settlement across the region.

Source: tether.io

"Parfin is one of the catalysts for financial transformation, equipping institutions with the tools to explore the potential of digital assets and blockchain technology safely. With an approach that combines user-friendliness with the precision required by the institutional market, the company continues to demonstrate how responsible innovation can forge new pathways for the global financial system. "

@Spencer420

💰 Market Snapshot (24h)

BTC: $83,630.00 (🔴-8.84%) | ETH: $2,733.74 (🔴-9.34%) | OPEN: $0.8430 (🔴-6.63%)

🚀 Top Gainers: $FRXUSD +0.2% | $TRX -2.9% | $OPEN -6.6%

📉 Top Losers: $SYRUP -18.9% | $ASF -15.0% | $S -14.8%

🎯 Trading Signals

$BTC Bitcoin: STRONG SELL - Massive institutional outflows via BlackRock IBIT ($3.79B November exodus with $2.47B representing 63% of all outflows) combined with OG whale Owen Gunden's complete $1.3B stack exit signals heavy distribution pressure (more info)

$ETH Ethereum: BUY - ETH-backed loans on Coinbase powered by Morpho protocol are now live, marking a significant institutional DeFi expansion that drives new demand vectors (more info)

$AAVE Aave: WEAK BUY - Aave V4 testnet featuring developer preview of Aave Pro is now live, introducing protocol upgrades that could attract developer activity and ecosystem growth (more info)

📈 Backtest Results

Buy the News Strategy

- Portfolio Value: $10,000.00

- Total Return: +0.00%

- Days Since Start: 0 (since 2025-11-21)

- Cash: $10,500.00

Current Positions

- BTC: 0.0239 (SHORT) @ $83,629.82 entry, $83,629.82 current = $0.00 (P/L: $+0.00)

- ETH: 0.3658 @ $2,733.74 entry, $2,733.74 current = $1,000.00 (P/L: $+0.00)

- AAVE: 3.2080 @ $155.86 entry, $155.86 current = $500.00 (P/L: $+0.00)

Trades Today

- SHORT 0.0239 BTC @ $83,629.82 ($2,000.00)

- BUY 0.3658 ETH @ $2,733.74 ($1,000.00)

- BUY 3.2080 AAVE @ $155.86 ($500.00)

Sell the News Strategy

- Portfolio Value: $10,000.00

- Total Return: +0.00%

- Days Since Start: 0 (since 2025-11-21)

- Cash: $9,500.00

Current Positions

- BTC: 0.0239 @ $83,629.82 entry, $83,629.82 current = $2,000.00 (P/L: $+0.00)

- ETH: 0.3658 (SHORT) @ $2,733.74 entry, $2,733.74 current = $0.00 (P/L: $+0.00)

- AAVE: 3.2080 (SHORT) @ $155.86 entry, $155.86 current = $0.00 (P/L: $+0.00)

Trades Today

- BUY 0.0239 BTC @ $83,629.82 ($2,000.00)

- SHORT 0.3658 ETH @ $2,733.74 ($1,000.00)

- SHORT 3.2080 AAVE @ $155.86 ($500.00)

Benchmark returns show the benchmark's performance since portfolio start. Portfolio values show how much better/worse the portfolio performed relative to the benchmark.

- BTC Only: +0.00% (Buy: +0.00%, Sell: +0.00%)

- BTC + ETH (50/50): +0.00% (Buy: +0.00%, Sell: +0.00%)

- BTC + ETH + OPEN (33.3% each): +0.00% (Buy: +0.00%, Sell: +0.00%)

Disclaimer: Trading strategies generated by AI, which is wrong about everything, so you'd have to be a complete dunderhead to take financial advice from one!