🔥 Top Stories

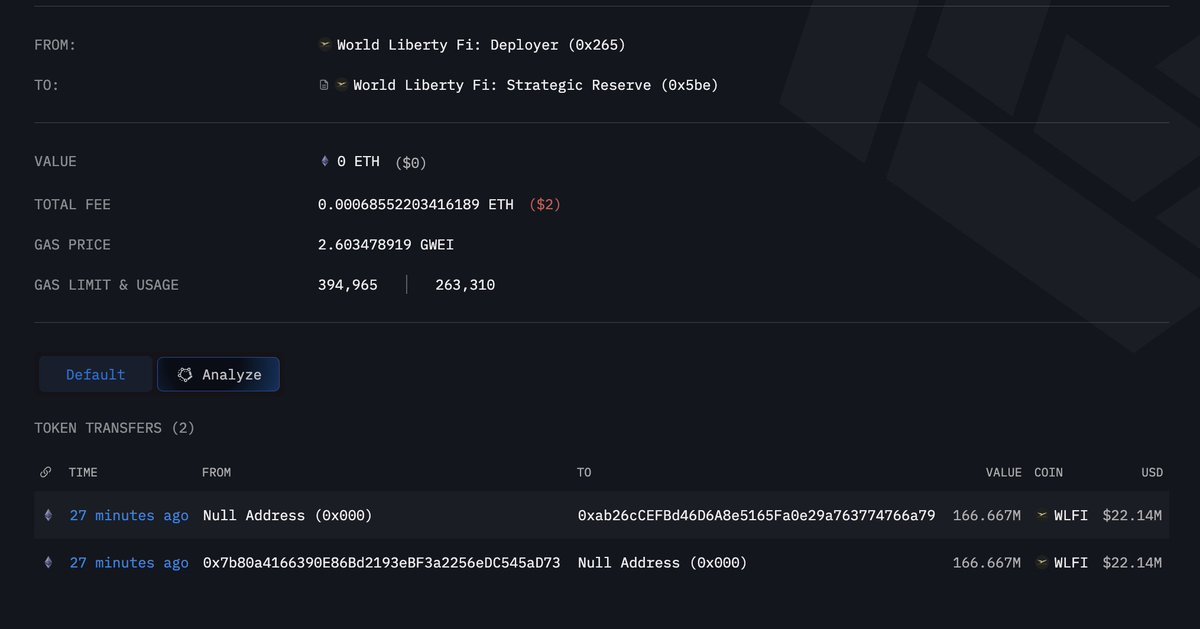

1. World Liberty Fi deploys its emergency kill-switch, torching 166.7M $WLFI ($22M) from a compromised wallet and rerouting the funds to a secure recovery address.

Source: 𝕏/@emmettgallic

@

2. Crypto-backed debt hit a new all-time high in Q3 2025, driven by onchain borrowing as lending apps now dominate 80% of the market—marking a far more disciplined environment than the 2021–22 leverage boom.

Source: Galaxy

@

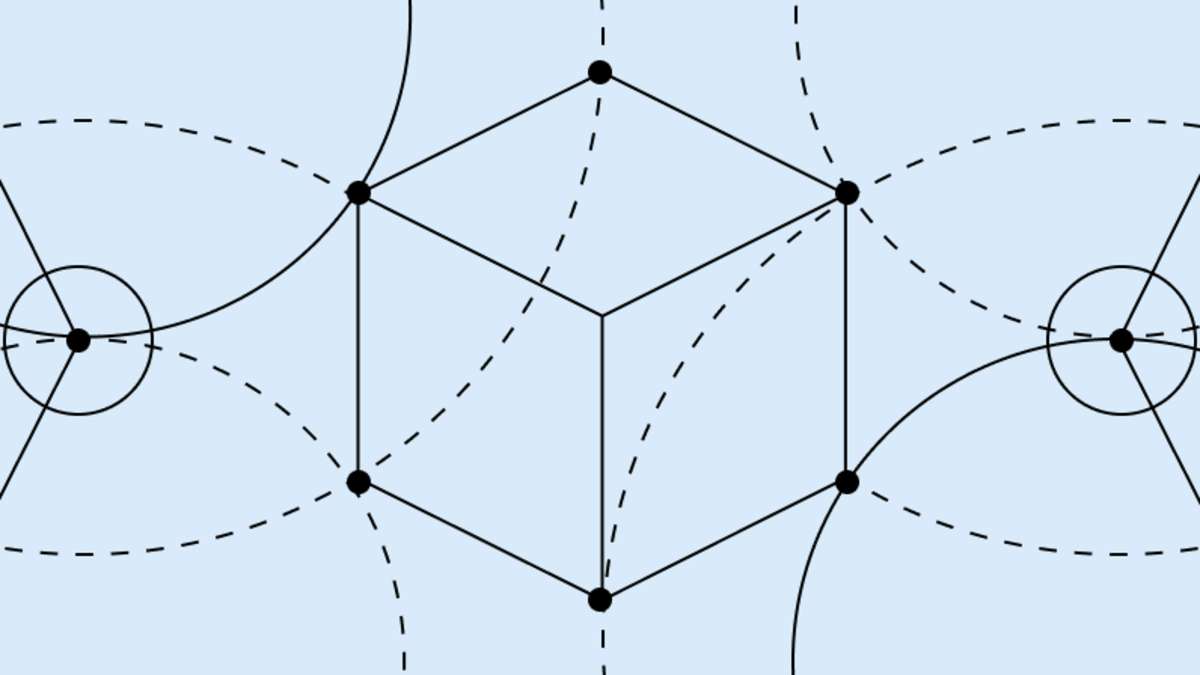

3. The Ethereum Foundation proposes the Ethereum Interop Layer to reduce L2 fragmentation via ERC-4337 account abstraction

Source: blog.ethereum.org

TL;DR:

Ethereum’s Account Abstraction team proposes the Ethereum Interop Layer (EIL) — a trustless, wallet-centric system that makes all L2s feel like one unified chain. Users can sign once and perform cross-chain transfers, swaps, or mints directly from their wallet with no bridges, relayers, or chain-specific steps. EIL keeps core Ethereum values (self-custody, censorship resistance, verifiability) while moving all logic onchain. The goal: one signature, one wallet, many L2s — a seamless Ethereum experience without fragmentation.

@Danicjade

4. Balancer releases its full post-mortem on the November 3 exploit

Source: 𝕏/@Marcus_Balancer

TL;DR:

Balancer suffered a major exploit on Nov 3, 2025, where ~$94.8M was stolen from legacy V2 Composable Stable Pools due to a rounding error in exact-out swaps amplified by low liquidity and rate providers. Most other pools and Balancer V3 were unaffected. A rapid, coordinated response from security partners, whitehats, and foundations helped protect or recover ~$45.7M. V2 stable pools are being sunset, and LPs are encouraged to migrate to V3. Recovered funds will be returned pool-by-pool through governance, and Balancer continues legal and technical efforts to recover remaining stolen assets.

@Danicjade

5. Societe Generale issues its first digital bond in the United States on blockchain, which was made using Broadridge Financial Solutions, Inc.’s tokenization capability on the Canton Network blockchain.

Source: Societegenerale

Blockchain getting more use case everyday 🤩🤩

@Danicjade

🎯 Trading Signals

$AAVE Aave: BUY - Crypto-backed debt hit ATH in Q3 2025 with lending apps commanding 80% of onchain borrowing market, validating strong institutional demand for lending infrastructure (more info)

$ETH Ethereum: WEAK BUY - Ethereum Foundation's Interop Layer proposal via ERC-4337 account abstraction addresses L2 fragmentation, positive catalyst for ecosystem cohesion and developer adoption (more info)

📈 Backtest Results

Buy the News Strategy

- Portfolio Value: $10,000.00

- Total Return: +0.00%

- Days Since Start: 0 (since 2025-11-19)

- Cash: $7,000.00

Current Positions

- ETH: 0.3395 @ $2945.76 entry, $2945.76 current = $1,000.00 (P/L: $+0.00)

- CRV: 1186.8338 @ $0.42 entry, $0.42 current = $500.00 (P/L: $+0.00)

- AAVE: 8.6663 @ $173.08 entry, $173.08 current = $1,500.00 (P/L: $-0.00)

Trades Today

- BUY 5.7775 AAVE @ $173.08 ($1,000.00)

Sell the News Strategy

- Portfolio Value: $10,000.00

- Total Return: +0.00%

- Days Since Start: 0 (since 2025-11-19)

- Cash: $13,127.50

Current Positions

- ETH: 0.3395 (SHORT) @ $2945.76 entry, $2945.76 current = $0.00 (P/L: $+0.00)

- CRV: 1305.5172 (SHORT) @ $0.42 entry, $0.42 current = $0.00 (P/L: $+0.00)

- AAVE: 9.1141 (SHORT) @ $173.08 entry, $173.08 current = $0.00 (P/L: $+0.00)

Trades Today

- SHORT 5.7775 AAVE @ $173.08 ($1,000.00)

Benchmark returns show the benchmark's performance since portfolio start. Portfolio values show how much better/worse the portfolio performed relative to the benchmark.

- BTC Only: +0.00% (Buy: +0.00%, Sell: +0.00%)

- BTC + ETH (50/50): +0.00% (Buy: +0.00%, Sell: +0.00%)

- BTC + ETH + OPEN (33.3% each): +0.00% (Buy: +0.00%, Sell: +0.00%)

Disclaimer: Trading strategies generated by AI, which is wrong about everything, so you'd have to be a complete chowderhead to take financial advice from one!