📊 Crypto Trading Signals - October 31, 2025

📊 Crypto Trading Signals

October 31, 2025

Squid Digest - AI-powered insights for crypto natives

📊 Crypto Trading Signals - October 31, 2025

🔥 Top Stories

🎯 Trading Signals

October 2025 Crypto Market: Leverage Flush and Mid-Cycle Reset

The October 2025 crypto market experienced a significant deleveraging event that has reshaped near-term sentiment. Here's what the data shows:

The October Crash and Recovery Context

Bitcoin experienced a brutal $19 billion liquidation cascade on October 10-11, with BTC plunging 14% to $104,782 while Ethereum dropped 12%.[1] Smaller altcoins suffered 40-70% declines, marking one of the largest single-day wipeouts in crypto history. However, this wasn't a random collapse—it was a predictable consequence of an overheated market colliding with systemic shock, primarily driven by regional liquidity tightening in Asian trading hours.[5]

Current Market State (October 31)

As of today, Bitcoin has slid below $108,000, now 7% lower from $116,000 just 72 hours ago, setting up October for its worst monthly return in over a decade.[3] The Fed's surprisingly hawkish stance this week (announcing rate cuts are "far from assured") has outweighed positive trade news between the U.S. and China, keeping downward pressure on crypto assets.

Key Structural Developments

Leverage Normalization: Futures open interest peaked at $52 billion before cascading liquidations normalized leverage to the 61st percentile, a healthy reset.[5] VanEck analysts frame this as a mid-cycle correction, not the start of a bear market, given Bitcoin prices are now near one-year lows relative to gold.

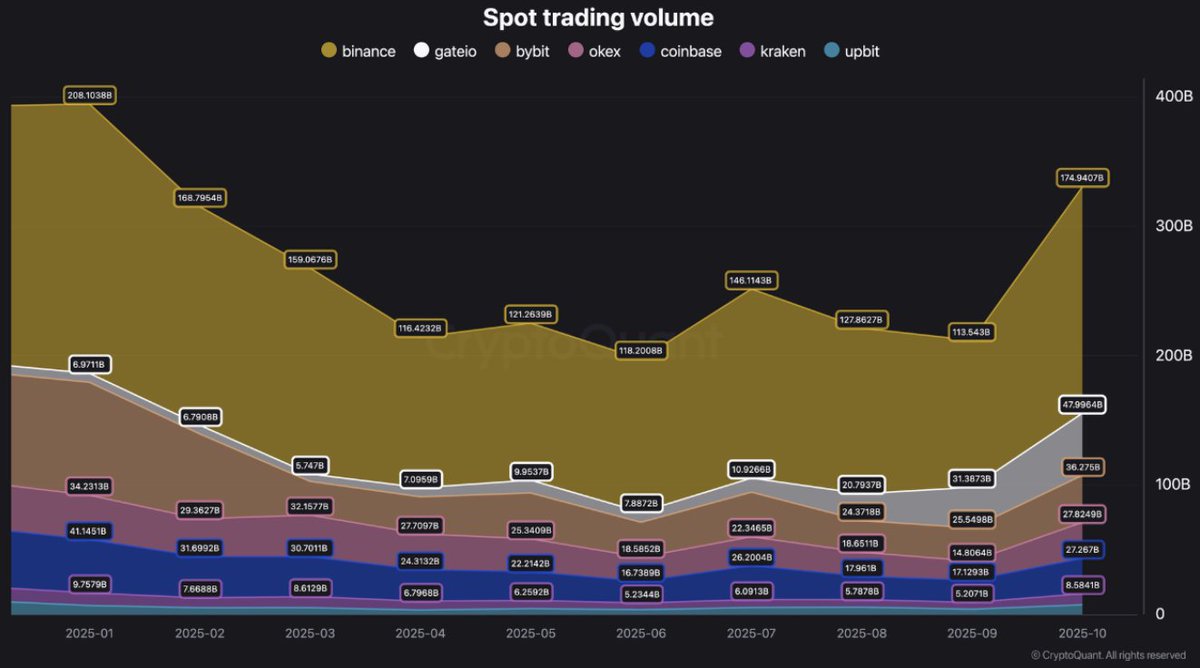

DEX Volume Surge vs. Token Weakness: Spot DEX volumes climbed to a new yearly high of $178 billion, yet DEX token valuations continue lagging—a divergence suggesting either a catch-up opportunity or a signal that token value propositions aren't keeping pace with activity.[2] Notably, perpetual DEX volume relative to CEX volume has hit all-time lows at 1.9x (historically 5-10x), driven by "perp dex mania" following Aster's launch.

Stablecoin Pressure: Ethena's USDe contracted from $14 billion to $10 billion market cap over 30 days as funding rates compressed, though recovery to 2-4% could reverse the trend.[2]

Record Options Expiry: Over $16 billion in Bitcoin and Ethereum options expire today (October 31) at 8:00 UTC on Deribit, potentially catalyzing volatility.[11]

Market Takeaway

This is a mid-cycle liquidity reset, not a structural breakdown. Global M2 growth remains the dominant driver of Bitcoin's price variance, and on-chain activity suggests a maturing market rather than capitulation. Traders should monitor today's options expiry closely, as it could provide the volatility needed to establish directional bias into Q4.

Generated by Squid Digest - AI-powered trading signals for crypto natives

Generated by Squid Digest - AI-powered trading signals for crypto natives

Powered by Leviathan News & Perplexity AI