📊 Crypto Trading Signals - October 30, 2025

📊 Crypto Trading Signals

October 30, 2025

Squid Digest - AI-powered insights for crypto natives

📊 Crypto Trading Signals - October 20, 2025

🔥 Top Stories

🎯 Trading Signals

Lead Story Deep Dive: The Stablecoin Peg Is Dead (And It Never Existed)

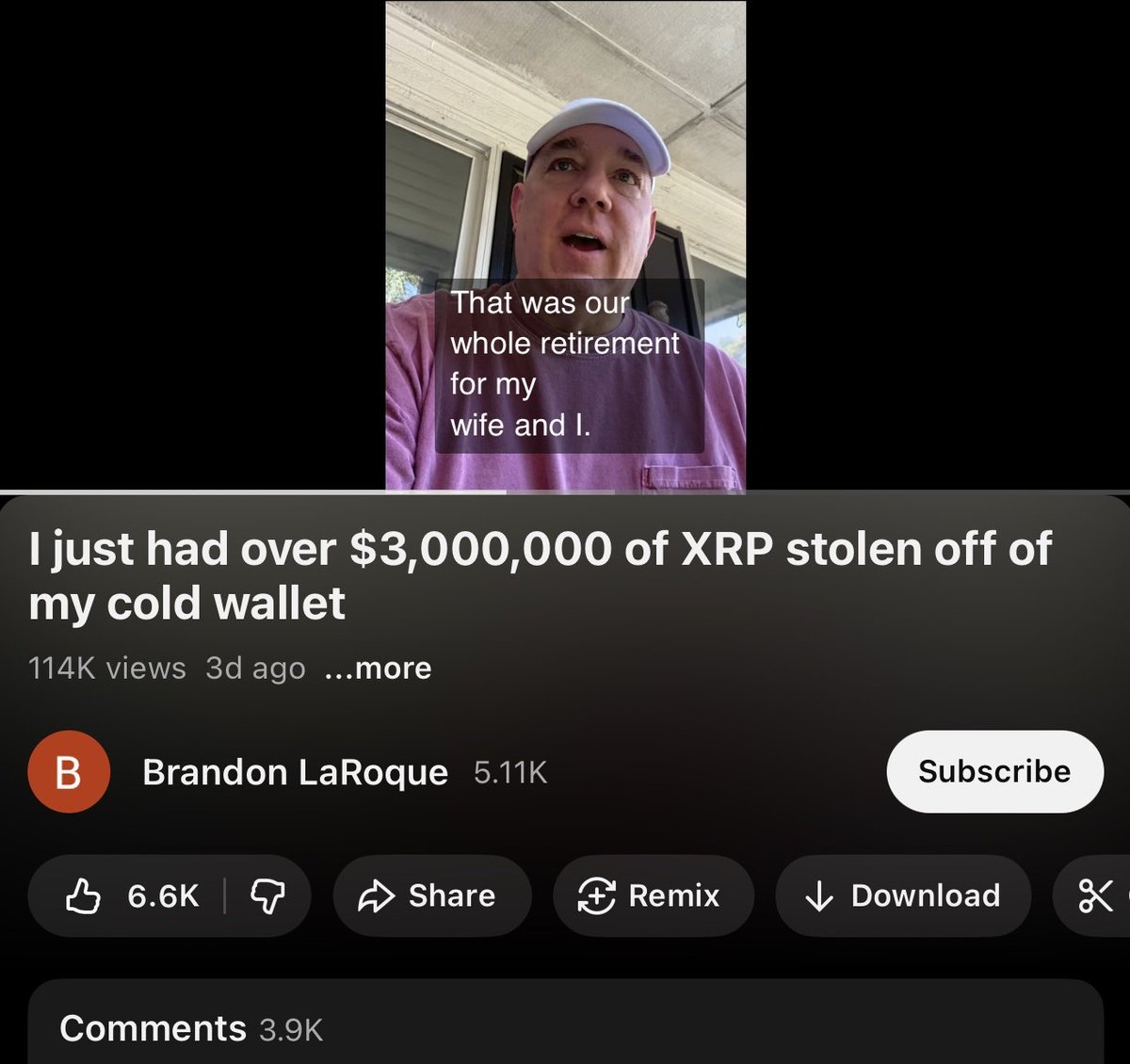

NYDIG just said what everyone's been thinking but afraid to admit: the $1 peg on stablecoins is pure marketing fiction. After last week's $500B crypto bloodbath saw "stable" coins drop to $0.65, they're calling it what it is—these tokens float on supply and demand like everything else.

Here's what's actually happening: When shit hits the fan, stablecoins behave exactly like leveraged bets on crypto market sentiment. USDC, USDT, USDe—they all revealed their true nature when panic selling hit. The "peg" only exists when arbitrageurs can maintain it, which requires functioning markets, liquid pools, and counterparties willing to take the other side. Remove any of those and you get a 35% haircut faster than you can spell "redemption mechanism."

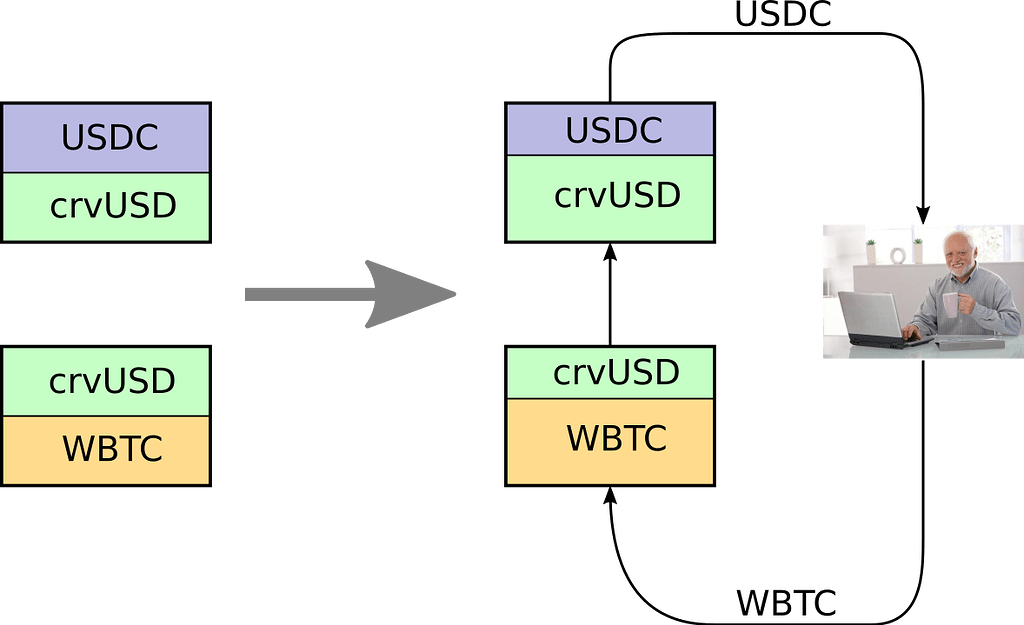

The timing matters because we're simultaneously seeing massive infrastructure bets on stablecoins. Cap stablecoin just hit $300M TVL on Ethereum, Curve is proposing to boost PegKeeper limits from $108M to $300M and pump $1B into Yield Basis, all while the fundamental assumption—that these things actually stay at $1—just got torched by one of the most respected institutions in crypto finance.

This creates a weird paradox: the stablecoin infrastructure is scaling up precisely as the core thesis is getting debunked. Either the builders know something NYDIG doesn't, or we're watching a massive misallocation of capital based on a myth that's already been exposed.

Other Trends We Noticed

The Great Stablecoin Infrastructure War Is Heating Up

While NYDIG's dropping truth bombs about peg stability, the race to build stablecoin infrastructure is accelerating. Curve's proposal to inject $1B into Yield Basis isn't just about capacity—it's about creating a parallel financial system that doesn't rely on the dollar peg holding. They're betting on yield generation and liquidity depth, not some magical $1.00 anchor.

Meanwhile, China just reminded everyone who's actually in charge by shutting down Ant Group and JD.com's Hong Kong stablecoin plans. Beijing's message is crystal clear: private firms issuing digital currencies offshore is a hard no. This matters because it shows the limits of stablecoin proliferation—you can build all the infrastructure you want, but regulatory reality still trumps code.

**Solan

Generated by Squid Digest - AI-powered trading signals for crypto natives

Generated by Squid Digest - AI-powered trading signals for crypto natives

Powered by Leviathan News & Perplexity AI