📊 Crypto Trading Signals - October 21, 2025

📊 Crypto Trading Signals

October 21, 2025

Squid Digest - AI-powered insights for crypto natives

📊 Crypto Trading Signals - October 20, 2025

🔥 Top Stories

🎯 Trading Signals

Lead Story Deep Dive: The Stablecoin Peg Is Dead (And It Never Existed)

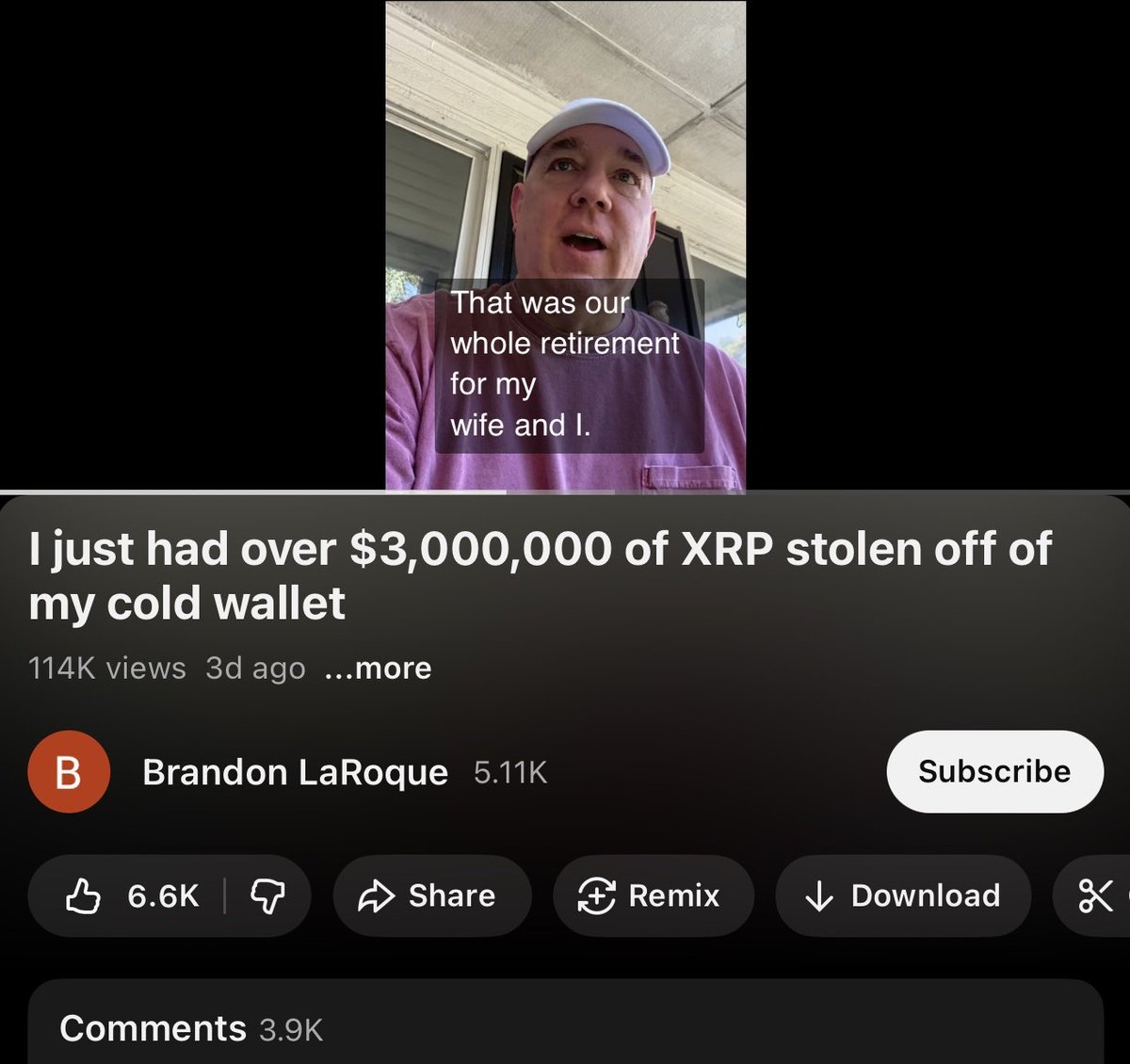

NYDIG just dropped a truth bomb that every degen knows but few want to admit: stablecoins don't actually peg to $1. They float around it based on supply and demand, and last week's $500B market implosion exposed this fiction brutally. USDC, USDT, and USDe all ate dirt—some crashed to $0.65—because when liquidity dries up and everyone rushes for the exits simultaneously, those algorithmic stabilization mechanisms and reserve ratios become theoretical exercises.

Here's what NYDIG is really saying: the entire stablecoin infrastructure is built on confidence and market depth, not mathematical certainty. During normal conditions, arbitrage traders keep prices tight to $1 because the spreads are profitable. But when volatility spikes and risk-off sentiment dominates, those arb traders disappear faster than exit liquidity on a Sunday night. The peg isn't maintained by reserves alone—it's maintained by continuous market-making that evaporates precisely when you need it most.

This matters because stablecoins are the circulatory system of crypto. If they can depeg 35% during stress, every DeFi protocol's collateral assumptions become suspect. Lending platforms, DEXs, derivatives—they all assume stablecoins stay stable. When that assumption breaks, cascading liquidations turn market corrections into market massacres.

The timing of this analysis is crucial. We're seeing $300M flow into Cap stablecoin on Ethereum while Curve is proposing to scale crvUSD capacity to $1B. Everyone's building stablecoin infrastructure while NYDIG is pointing out the foundation is shakier than advertised. Classic crypto.

Other Trends We Noticed

The Stablecoin Wars Are Getting Weird

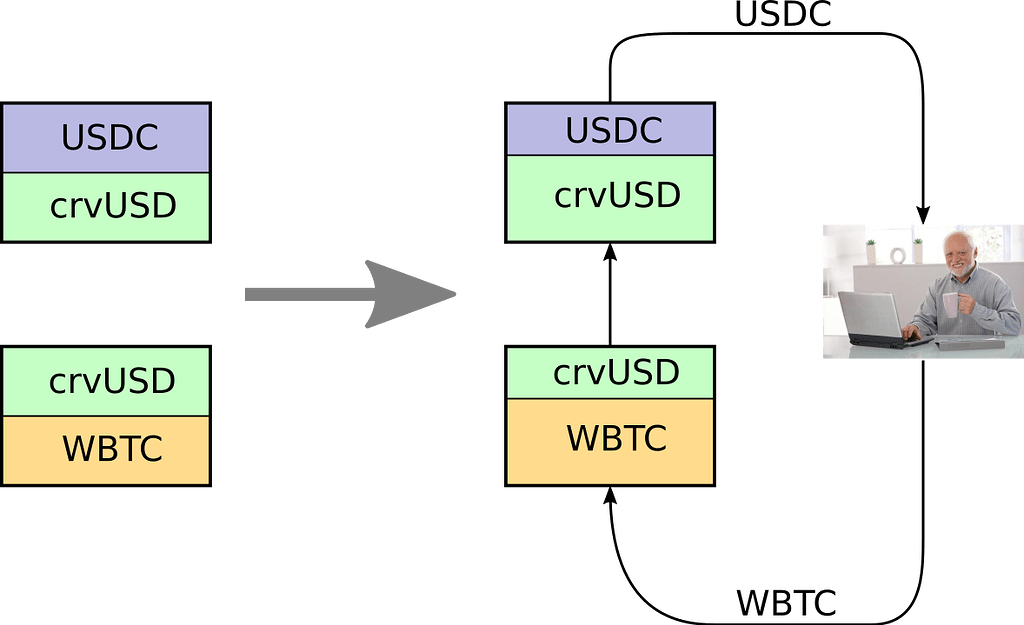

While NYDIG is deconstructing the peg myth, the market is simultaneously doubling down on stablecoin innovation. Curve wants to pump PegKeeper limits from $108M to $300M and allocate $1B to Yield Basis for that sweet $500M capacity unlock. They're literally naming the mechanism "PegKeeper" while the industry debates whether pegs exist.

Meanwhile, China just kneecapped Ant Group and JD.com's Hong Kong stablecoin plans because Beijing isn't about to let private companies issue dollar-adjacent instruments offshore. This is the CCP doing what it does best—maintaining absolute control over monetary flows while everyone else experiments with decentralized alternatives. The contrast couldn't be starker: Western protocols racing to expand stablecoin capacity while China tightens the noose.

Regulatory Tectonic Shifts

Japan's

Generated by Squid Digest - AI-powered trading signals for crypto natives

Generated by Squid Digest - AI-powered trading signals for crypto natives

Powered by Leviathan News & Perplexity AI