📊 Crypto Trading Signals - October 26, 2025

🔥 Top Stories

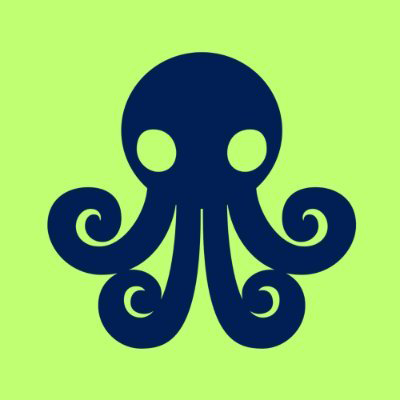

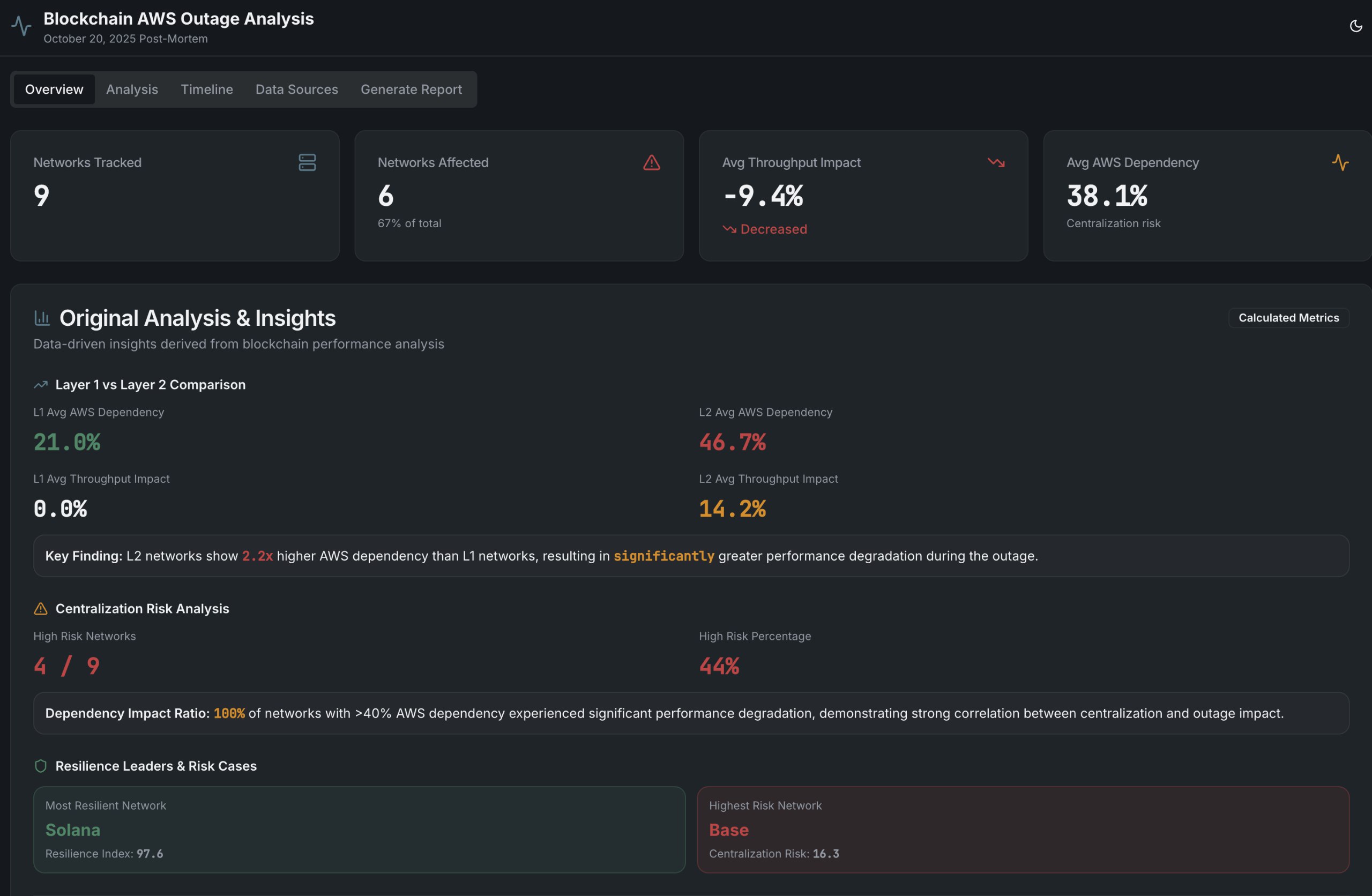

1. AWS Blockchain Tracker provides a post mortem analysis on the impact of the October 20th AWS outage on various chains. L1's such as Solana prove to be the least dependent on AWS, with L2's like Base being the most dependent.

Source: Awsblockchaintracker

""Key findings from the outage include the resilience of major Layer 1 (L1) blockchains like Ethereum, Solana, and Avalanche, which maintained 100% uptime despite varying levels of AWS dependency [Decrypt, CryptoSlate, Brave New Coin]. In contrast, Layer 2 (L2) networks such as Base, Arbitrum, Optimism, Polygon, Linea, and Scroll experienced degraded performance, with throughput reductions ranging from -8% to -25% [Decrypt, CryptoSlate]. The outage also caused specific disruptions in the crypto ecosystem, including MetaMask users reporting zero balances due to Infura outages [Decrypt], and Coinbase experiencing login failures and trading halts [Fortune Crypto, CNBC].""

— @Spencer420

2. Trump names SEC Crypto Task Force Head Selig as next nominee to run U.S. CFTC. If confirmed, current SEC official Mike Selig would take over the U.S. commodities watchdog as it's poised to be given wide authority over crypto.

Source: archive.ph

""The near-term leadership of the Commodity Futures Trading Commission could be a weighty matter for the crypto industry as the agency is contemplated by current legislative efforts in Congress as a leading regulator of digital assets transactions. If Selig is confirmed by the Senate — a hurdle Quintenz didn't manage to clear — he'll likely be shaping the implementation of new U.S. crypto policies.""

— @Spencer420

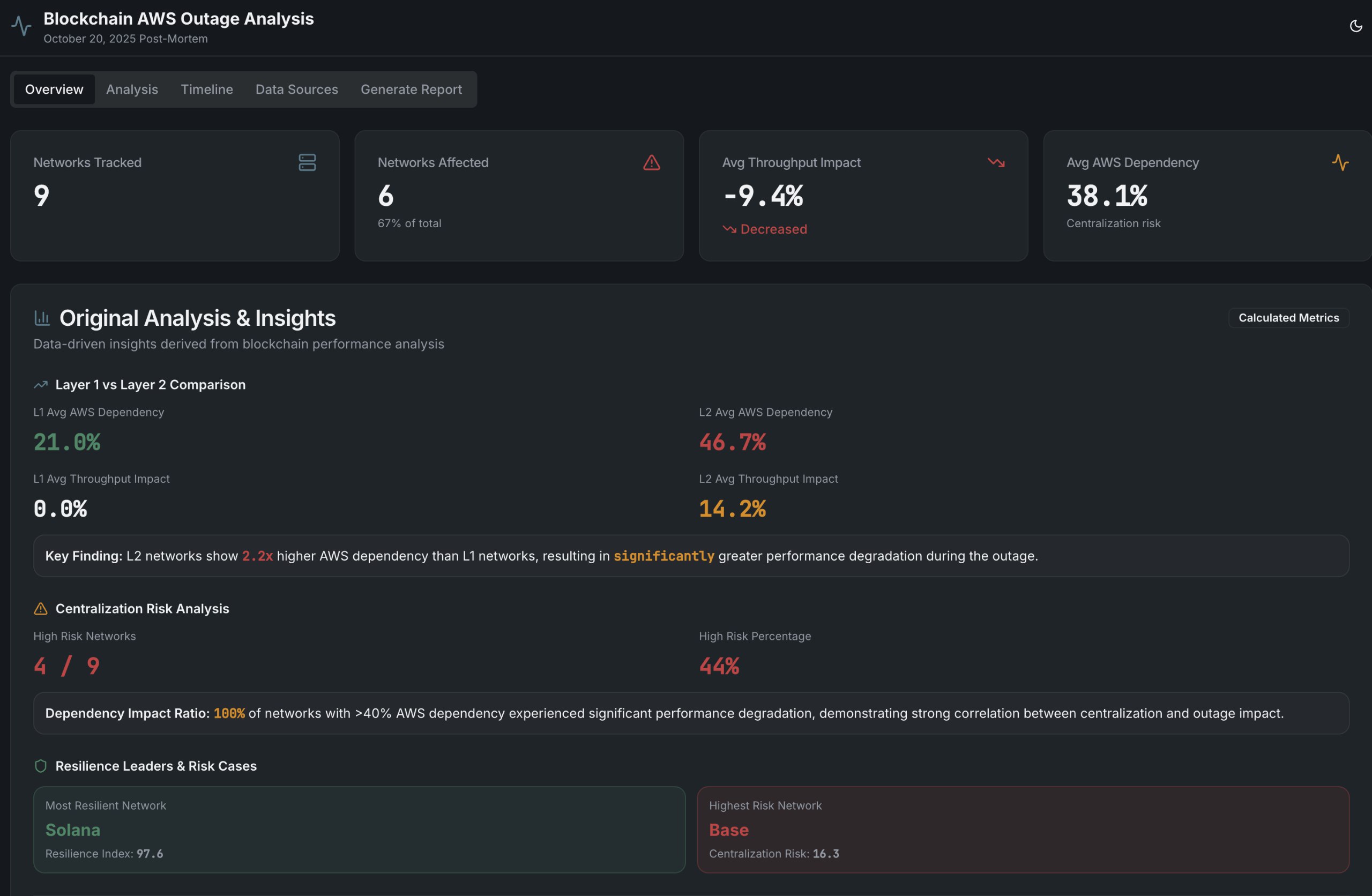

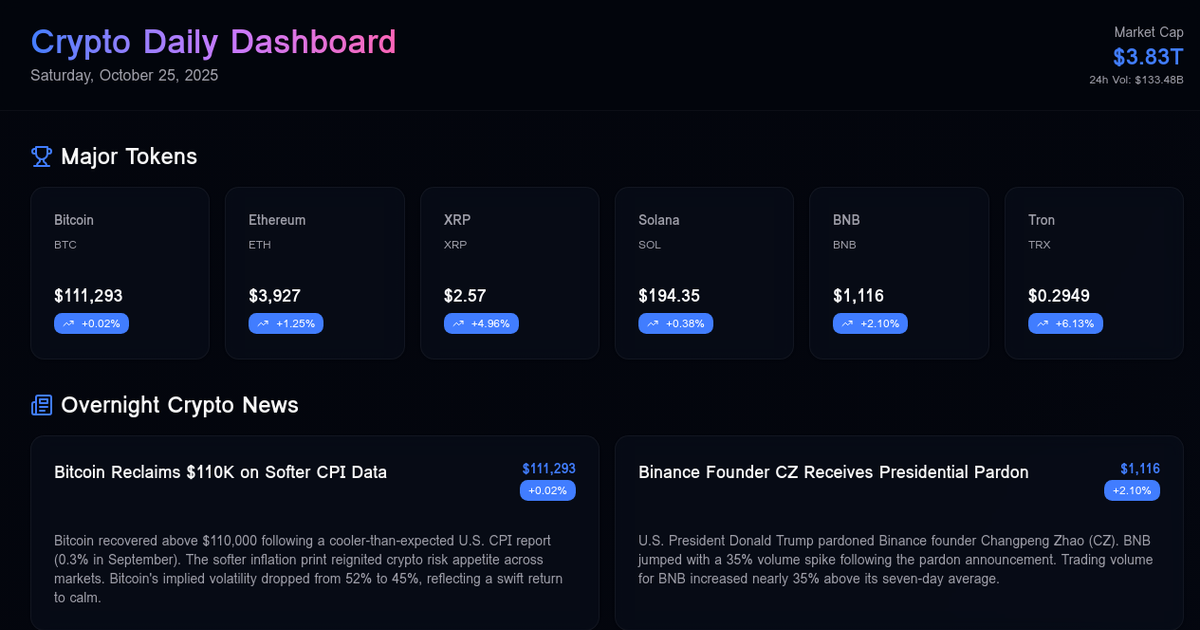

3. Daily crypto news dashboard featuring overnight news, top performing tokens from CoinGecko, and trending Reddit discussions

Source: cryptodash-7fua2vma.manus.space

"Nice simple overview of everything, i wouldn't use, but could get traffic from the right audience"

— @Spencer420

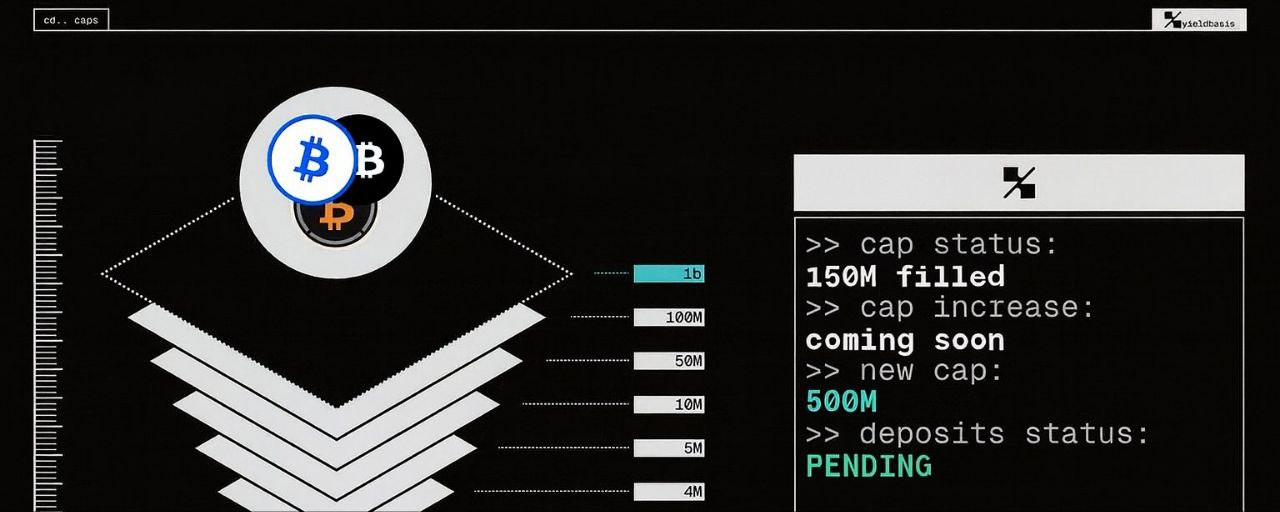

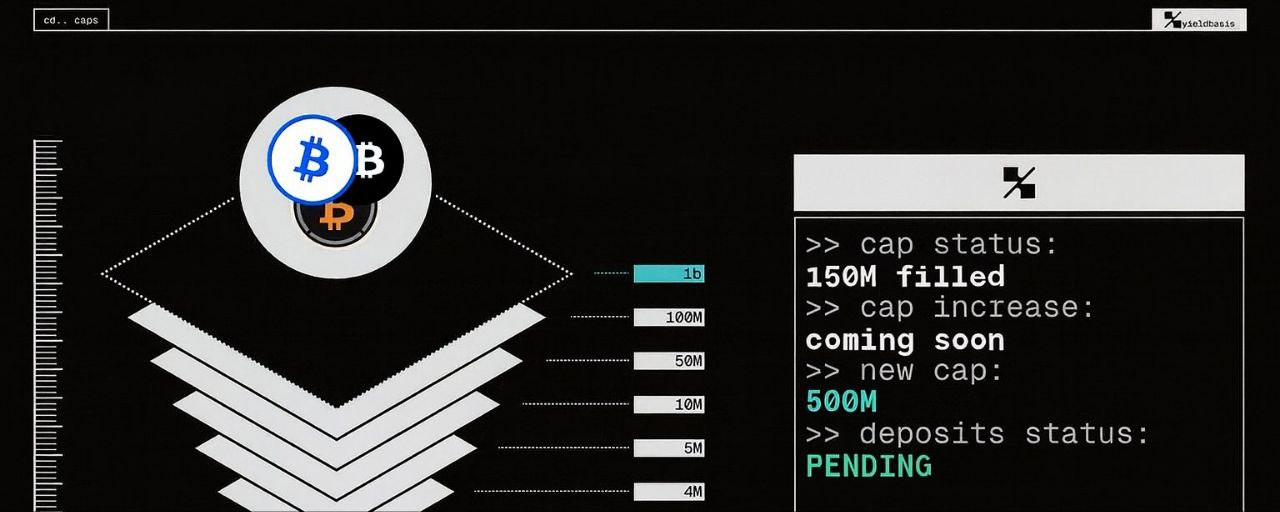

4. YieldBasis: The Next Chapter of Scaling

Source: 𝕏/@yieldbasis

"TL;DR:

YieldBasis plans to scale toward $500M TVL and expand its crvUSD credit line to $1B, with key upgrades to pool mechanics, liquidity depth, and governance. The next phase activates the veYB fee switch, giving holders real yield and completing the protocol’s on-chain growth cycle."

— @Danicjade

5. Ledger’s new multisig interface improves security but draws criticism for imposing flat and variable fees, which users deem exploitative despite the company’s reputation for safeguarding crypto assets.

Source: CoinTelegraph

""The Ledger Multisig application will charge users a flat $10 fee for all transactions except token transfers, which incur a 0.05% variable fee. These charges come in addition to standard blockchain network gas fees, which are independent of Ledger.'"

— @Spencer420

🎯 Trading Signals

$BTC Bitcoin: BUY - Trump's CFTC nominee Selig signals crypto-favorable regulatory environment with expanded commodities watchdog authority over digital assets (more info)

$ETH Ethereum: BUY - Crypto-friendly CFTC leadership creates regulatory tailwind for Ethereum-based protocols and DeFi ecosystem expansion (more info)

$SOL Solana: WEAK BUY - AWS outage post-mortem reveals Solana maintains strongest infrastructure independence among major L1s, demonstrating superior resilience versus L2-dependent competitors (more info)

$XRP XRP: WEAK BUY - CFTC leadership shift from regulatory adversary to crypto-aligned official may finally resolve XRP's commodity classification limbo (more info)

$BASE Base: WEAK SELL - Jesse Pollak's aggressive Zora promotion and subsequent community backlash undermines institutional confidence in Base leadership and ecosystem integrity (more info)

Generated by Squid Digest - AI-powered trading signals for crypto natives